There’s an old story about an economist who sees a $20 bill lying on the street but won’t pick it up. Relying on his academic training he explains that the market is efficient and if there really were a $20 bill in the street, someone else would have already snatched it.

Well… having spent nearly 30 years investing in stocks, you can guess that I don’t believe in the strong form of the Efficient Market Hypothesis. I believe that exceptional opportunities exist both in the stock market and in real estate, but it’s important to consider why that might be the case. I, therefore, spend a ton of time testing, and challenging, my own assumptions around real estate investing.

Earlier this month, as I prepared for a presentation to the Multifamily Investors Network of Massachusetts Meetup Group, I came across a white paper from the National Multifamily Housing Council Research Foundation that analyzed the excess performance of apartments. The paper, Explaining the Puzzle of High Apartment Returns, was written in 2018 by two professors, Mark J. Eppli, Ph.D and Charles C. Tu, Ph.D.

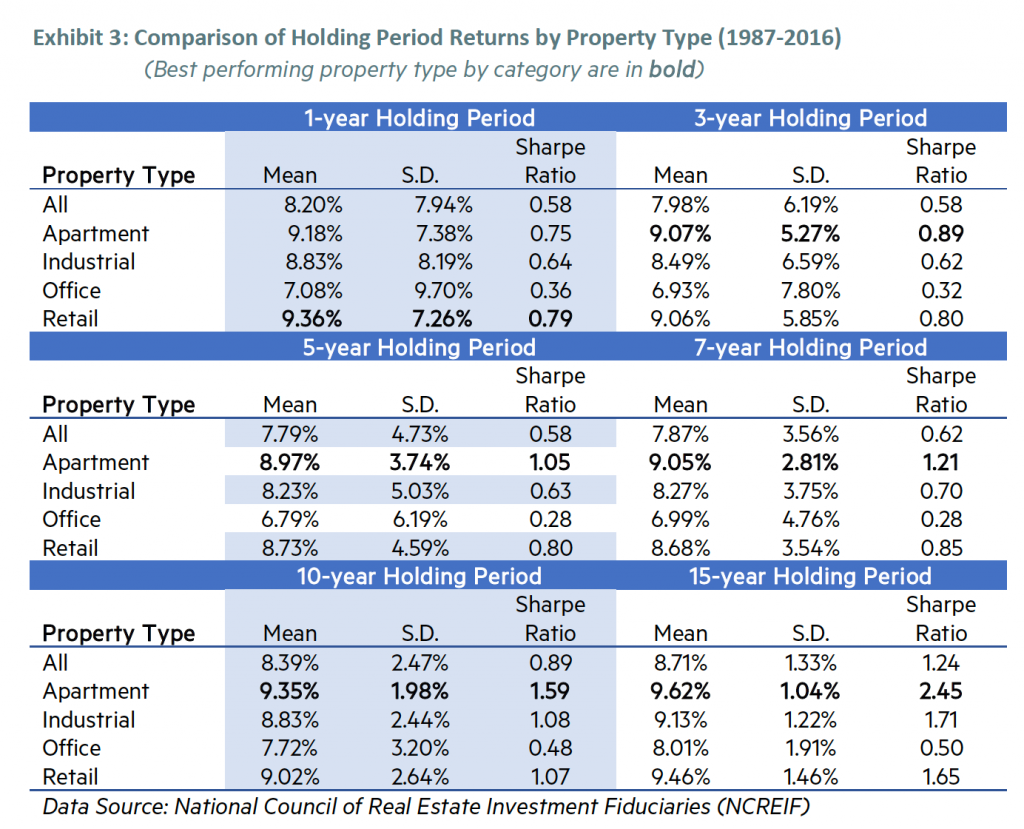

The paper examines the performance of real estate assets over a 30 year period across different geographic regions, in markets with different rates of employment size/growth, and with higher/lower cap rates. What is clear is that apartments dominate the other asset classes on a risk-adjusted basis. The report suggests some possible explanations such as

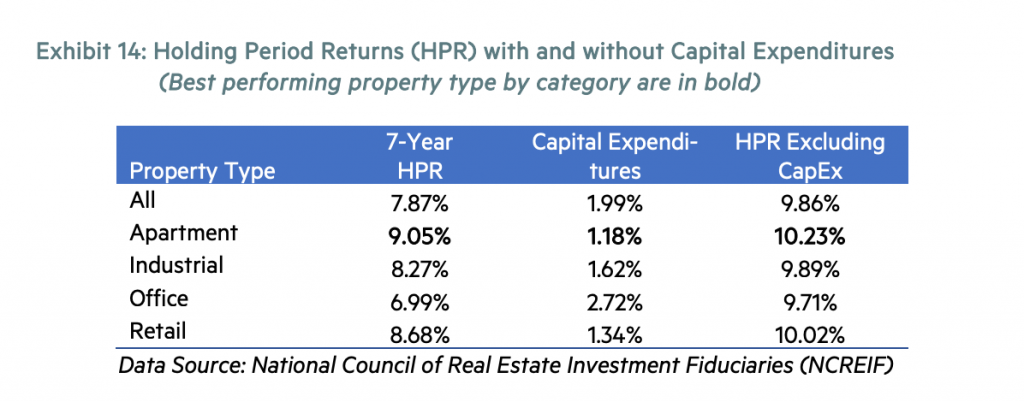

In addition to more stable rental income (and therefore less dramatic drawdowns), the authors suggest that investors in offices and industrial assets underestimate capex in their asset pricing relative to apartment investors. It’s typical for apartment investors including Cove to include a capex reserve of $250-$300/unit in addition to planned renovation capex.

Let’s keep in mind that this research was commissioned by an apartment industry research foundation. Still, the capital intensity explanation makes some sense. Cap rates and NOI, like PEs in the stock market, are limited valuation proxies that fall short of a proper analysis of after-tax cash flows.

We can add capital intensity to other possible explanations like a liquidity premium for private assets, tax incentives, and market inefficiency.