Cove Investments Blog

Boom Time For Home Prices

In the early days of the pandemic, pundits broadly agreed that everybody would flee the cities in favor of suburban single-family homes. Preferences aside, that never seemed to be a realistic outcome. In August, I wrote a blog post, Risks to Class B/C Multifamily Investing, on this topic, arguing as follows: Supply constraints make an apartment exodus impossible in practice – we can’t push a button and automatically have millions of new homes – it also ignores the issue of affordability when demand exceeds supply. Millions of apartment residents would probably move to a home today, either to rent or to buy, if

Population Growth and Home Price Appreciation

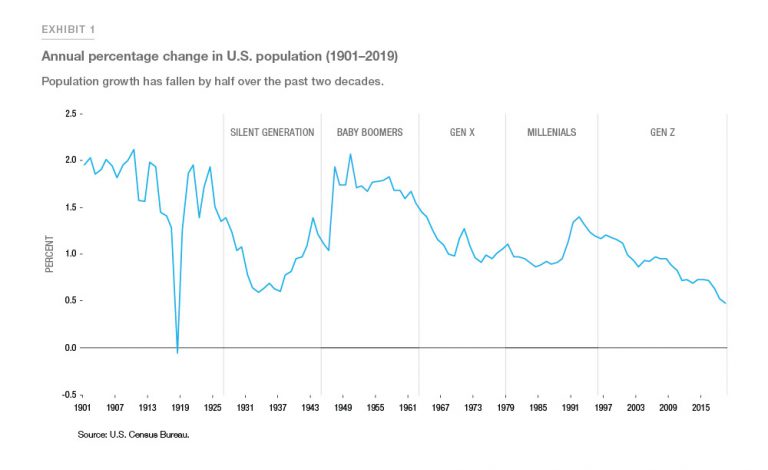

Freddie Mac recently published an excellent report called US Population Growth: Where is Housing Demand Strongest? Similar reports underscore the growth in sunbelt states and highlight the MSAs that are growing fastest. The report highlights that US population growth is slowing. Therefore, real estate investors must focus more carefully on the composition of growth drivers (net migration vs. natural increases) and mobility trends within the US. The theme of migration from the north to the south is as powerful as ever, but it’s useful to remember that it’s happening within the context of a declining rate of domestic net migration. Even within

Sizing Exposure to Real Estate

What’s the right allocation to private equity real estate? The honest answer, as ever, is that it depends. It mostly depends on the individual’s risk tolerance, objectives, existing portfolio, and other tax, liquidity, and estate planning considerations. It also depends on what you mean by real estate, which can take many forms and carry a wide range of risk/return profiles. But to be helpful, I’ll usually say that I don’t think the answer is zero. And that’s where many of my clients begin this process, particularly those exposed to the stock market through their day jobs, bonus, personal account, and

On The Real Value of Strategists

Earlier in the week, I read a thought-provoking year-ahead strategy piece by KKR’s Henry McVey. In the note, called 2021: Another Voice, McVey shares a reasonably bullish outlook on the global macroeconomic landscape. I couldn’t tell you his 2021 year-end price target for the S&P 500, but I appreciated his framework and the way he distilled his thoughts into six themes. Specifically, we think that global allocators will need to champion investments that not only are set to thrive in a faster nominal GDP environment than in recent years, but also synch up with our six “mega macro themes”: the